Investments in space technology are off to a strong start in the first half of 2025. The rising trend over the last four years, as mentioned in a previous Knobbe Martens Aerospace Blog post, appears to be continuing. The quantity of deals in space technology has “more than doubled in the past four years,” per Reuters. While the number of deals in 2025 may not exceed that of 2024, total deal value this year may surpass last year’s total of $6.6 billion.

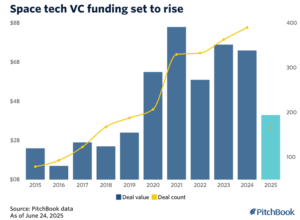

So far this year, total deal value in venture capital investments in space technology is at $3.3 billion across 166 deals, per Pitchbook. They report venture capital funding in the industry for the past ten years as shown here:

Further, investors appear to be favoring more mature space technology projects. The Pitchbook report reveals a slight increase this year as compared to last year in funding for “late-stage” deals to about 41%, which they report is the “highest percentage in a decade.”

Why do we see the investment interest in this area? Consider that launches to space are more reliable and less expensive than in decades past. On reliability, one study concludes that “even with a near-exponential increase in launch events in the 2020s, the number of failures is less than 6% each year, with the average success rate being 95% annually.” Another report shows that some launch vehicles can deliver payloads to orbit for around $1,500 per kilogram.

Pitchbook points to the increasing importance of space in national defense and the growing technological capabilities of adversary countries. This has spurred investments in the defense area. For example, this year a developer of military-class orbital systems raised a $260 million Series C round, and a satellite developer working on the company’s inaugural government project completed a $110 million Series B investment.

Investors have also shown interest in airborne projects closer to earth. Stratospheric balloon developer World View Enterprises completed a strategic Series D round earlier this year. We may also see increased investment activity for electric vertical takeoff and landing (eVTOL) vehicles and drones after a U.S. Executive Order signed by President Trump in June reportedly calls “for faster commercialization of eVTOLs and drones.” An eVTOL aircraft developer raised $850 million in June in a registered direct offering, reportedly providing the company with a “pro forma liquidity position of approximately $2B.” Another electric aircraft maker raised $94 million in new equity in June in support of its eVTOL efforts. Finally, United Airlines announced in April an investment in a company making a blended wing body (BWB) aircraft.

As competition in aerospace increases, intellectual property protection can provide a competitive edge. While patent filings and grants globally for “aerospace, defense, and security” have declined in the last five years, the U.S. trend may be rising given the investment in U.S.-based companies and as we move farther from the coronavirus pandemic which overlapped with that same period. As we reported earlier this year, the IEEE “Patent Scorecard,” which ranks patent portfolios in various industries, showed “Aerospace ranked 11th place among the 14 categories that IEEE analyzed.” Aerospace inventions can generally be protected in the U.S. with utility and design patents, even when those inventions are practiced in space, per the U.S. Space Act. For additional details on IP and space technology, see this presentation on Patent Basics for the Private Space Industry.